Argentina has several different currency exchange rates, which can be confusing for visitors.

If you’re wondering what the ‘Blue Dollar’ is and why it even exists, read this post and check our currency converter below to save yourself a lot of money while visiting Argentina.

Argentina’s Economy: A Brief History

Argentina enjoyed an abundant beginning to the 19th century and was one of the world’s richest countries only one hundred years ago.

The French coined the phrase, ‘rich as an Argentine’ after seeing their lavish spending habits in Europe during the Belle Époque.

Argentina still has a wealth of natural resources and fertile land.

The riches of yore are most evident in the capital, Buenos Aires.

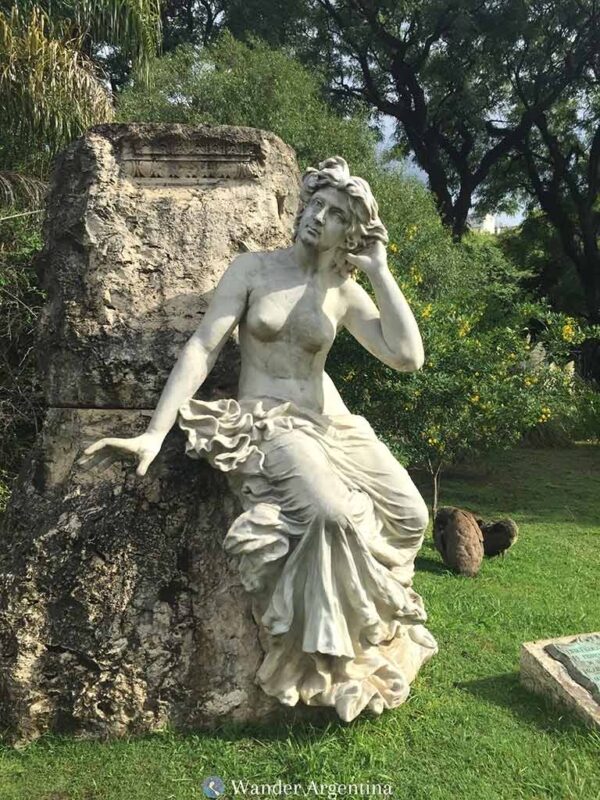

There are beautifully landscaped parks and plazas, buildings decked out in marble and brass, and elegant public statues such as the Nereids Fountain dotted all over the city.

The Argentine Paradox

Argentina’s previous wealth is most evident in some of the city’s biggest tourist attractions, such as Avenida de Mayo’s Tortoni Cafe and Recoleta Cemetery, where departed Argentines forever rest in the luxury of pricey mausoleums.

Since the golden days, a chaotic political landscape, a succession of military takeovers, corruption and free-for-all privatization in the 80s and 90s wreaked havoc on the economy.

Economists refer to the stark economic decline in Argentina as the ‘Argentine Paradox.’

How did a resource-rich country that had a similar GDP to Canada one hundred years ago fall so far?

It’s no mystery for those who live in Argentina (the unorthodox economic model for one thing!) nonetheless, countless essays have been written on the topic.

Rapper 50 Cent is known as ‘200 pesos’ in Argentina.

The Argentine Paradox is often contrasted with the Japanese Paradox.

As far as Argentina has fallen, Japan has risen. Japan experienced such economic growth that it grew to become the third-largest economy in the world in the same time frame, despite a scarcity of natural resources.

Before the economic collapse at the turn of the millennium, Argentina was a more expensive destination than Europe.

Argentina’s devastating 2001 economic crisis and the resulting devaluation of the peso meant lost savings for citizens who kept their money in the bank.

The country’s economic situation stabilized somewhat for citizens the decade after the turn-of-the-21st century crisis.

Employment increased and poverty rates fell for several years, but Argentina is on a constant roller coaster ride and the future is always uncertain.

For visitors, Argentina has gained a reputation as an affordable destination to visit and even reside, attracting digital nomads, and expats.

With destinations such as elegant Buenos Aires and the Alpine town of Bariloche, some liken it to visiting Europe on a South American budget.

Now those traveling to Argentina with foreign currency will still find it affordable (Buenos Aires’ fabulous subway still only costs US$.35 tops) but the future is uncertain as always.

Recent changes are shaking things up, and budget adjustments are making it tough for locals.

Foreign visitors are noticing higher costs too.

A Little History of the ‘Blue Dollar’

Argentina’s currency has seen historical fluctuations, largely influenced by political shifts and economic policies.

Under Cristina Kirchner’s presidency from 2007-2015 strict currency controls were introduced, leading to a substantial black market for dollars.

During these years, Argentina was popular with travelers who came for the six-dollar steak and Malbec dinners.

Things get confusing for those using old guidebooks because when Mauricio Macri’s became president in 2015, he stabilized the currency flow and largely diminished the use of the black market by foreigners.

Prices inched upwards during the few years the currency market was normalized, until September 2019, when the government reinstated its ‘creative’ currency controls amidst dwindling foreign exchange reserves.

This paved the way for the return of the Peronist government, with Cristina Kirchner serving as Vice President this time.

Once again, this change led to a divergence between the official bank exchange rate and the black market rate, commonly referred to as the ‘Dólar Blue‘ (Blue Dollar) rate.

To illustrate the huge gap between the official dollar and the Blue Dollar: in January 2021, the official rate for one U.S. dollar stood at approximately AR$86, while the parallel market offered around AR$151.

This spread escalated by January 2022, with the official rate at $104 and the parallel market soaring to $204.

Those numbers will be surprising for newcomers who learn that thanks to inflation the ‘Blue Dollar’ is now worth over AR$1000 per dollar.

Argentina’s Different Exchange Rates Today

Visitors will still want to leverage the Blue Dollar rate to optimize currency value.

The Blue or Black market dollar is listed in local newspapers as the ‘dólar informal‘ (informal dollar) while the ‘dólar oficial‘ (official dollar) is the official bank rate.

To confuse things further, there are a bunch of other exchange rates listed in newspapers.

One such exchange rate is the ‘Soy dollar’ that gives soybean farmers a favorable rate to boost the agricultural sector.

The ‘Qatar dollar’ was tied to the rate for those who traveled to view Argentina play the 2022 World Cup.

The “Netflix dollar’ is used to describe an inflated exchange rate tied to various taxes applied to foreign streaming services.

Less colloquial is ‘contado con liquidación‘ or the CCL rate, an investment rate of securities in pesos sold for dollars in foreign markets.

Money transfer services use this mechanism, thus they can sometimes offer better rates than the Blue Dollar.

Whatever you do: don’t exchange money in a bank in Argentina because that is where you’ll get the lowest rate.

¡Blue Dollar Still A Thing!

With Argentina’s ‘creative’ currency controls, the situation is that travelers can save money if they come to Argentina with U.S. dollars in cash, or even by using a money transfer service, which often offers a superior rate, to send money from a bank account at home.

The black market for the ‘Blue Dollars’ remains robust, as Argentineans don’t trust their currency and prefer to save dollars.

The Blue Dollar is still also thing for visitors who want to take advantage of the rate.

Not to mention cash is needed daily.

Many family-owned businesses want to avoid foreign credit card purchases due to fees.

It is common for smaller stores to offer an additional discount for cash or charge a 10-15% surcharge on foreign cards (illegal, but still done).

To exchange dollars on the black market you need crisp USD100 bills (usually dollars, but Euros and Reales are dealt on the black market too).

Outside of Buenos Aires, it may be more difficult to find money transfer services, especially in small towns, so it pays to carry some USD for backup.

Travelers may find they can even get more pesos in exchange for their US dollars in more remote areas of the country because people in the provinces have a harder time finding dollars to purchase.

On the other hand, it can sometimes be difficult to find a place to quickly change money in a pinch while traveling around the country, so make sure to have various options to access your money.

Carrying USD or Euros to exchange for pesos is also a good way to avoid, not just a bad official and lower MEP exchange rate, but also steep ATM fees, which run about a minimum of US$8 per withdrawal in Argentina, for any amount.

Understandably some don’t feel comfortable carrying lots of cash, but even those who don’t bring in foreign currency will be carrying wads of cash in Argentina, as the bill denominations are small, although the 2024 rollout of a $10,000 bill has alleviated the problem somewhat.

A light travel jacket with hidden inside pockets is a great option to conceal your cash.

→ To read about exchanging money on the street in the Buenos Aires black market, read Black Market Money Exchange & Other Hustles on Florida Street

Live Currency Converter

Try our currency converter to compare Argentina’s official, Blue Dollar rate and Western Union rate all in one place.

Input the number of dollars you want to exchange and press return to see the real live rate:

Keep in mind that these are the rates before ATM, Western Union and ‘arbolito‘ (money changing) fees.

Input a US$ amount

OFFICIAL RATE

US$ 1 = AR$

0

BLUE RATE

US$ 1 = AR$

0

WESTERN UNION

US$ 1 = AR$

0

MEP Credit Card/Debit Card Rate

The MEP (‘Electronic Payment Market’ in its Spanish acronym) rate, introduced in late 2022 to boost the use of traditional banking for visitors, offers a more favorable exchange rate using a debit or credit card.

As of 2024, the MEP rate closely mirrors the Blue Dollar rate or lags slightly behind.

CASH / BLUE DOLLARS

• Visitors, just like most Argentines, will be unable to get their hands on any foreign currency in Argentina, unless they use the black market. Most take advantage to sell ‘Blue Dollars’ at a favorable rate.

CREDIT CARD RATES

• A rate called the MEP rate was created in late 2022, allowing foreigners to receive the MEP rate for Mastercard and Visa debit and credit cards, which tend to be 3-10% less than the Blue rate.

Additionally the credit card companies are not very transparent about their fees for foreign conversion, which range wildly from 2.8%-12% (Visa took an average of 6% in a one month sample)

ATMs

• ATMs only remit Argentine pesos, at the MEP rate for most foreign cards (American Express is an exception) but have low withdrawal amounts and fees of around 20-30%

Read this post to figure out how to handle stacks of cash, and why you should bring ‘Big Headed Benjamins’ to exchange.

Relying on both the Blue Dollar or a money transfer service is better than ATMs. Most travelers avoid using ATMs because of their offensively high fees.

Argentina’s 2024 Currency Rollercoaster

Now that Javier Millie is president, and taking a chainsaw to Argentina’s spending, the spread between the official and blue dollar has shrunk, varying from 5-15%.

In theory, this means Argentineans have more purchasing power, but systematic inflation disrupts that notion.

Javier Milei intends to dollarize Argentina’s economy, which involves adopting the US dollar in place of the Argentine peso.

His long-term strategy aims to stabilize the economy to combat inflation and encourage foreign investment.

Argentina tried this policy in the early 1990s, after a similar period of recession and hyperinflation when the government fixed the peso’s exchange rate at one-to-one with the US dollar.

This move initially created a rare period of prosperity and Argentines gained the ability to travel abroad more affordably.

But the fixed exchange rate artificially inflated the peso’s value, creating an economic ‘fiction’ that collapsed under the weight of reality, causing the country’s devastating economic crash of 2001.

Milei’s current push for full dollarization is seen as a bold measure to normalize the economy and build confidence in Argentina, although many feel it is a risky policy, as the country’s history illustrates.

Argentina not only has incredible landscapes and exciting cities but also one of the world’s most dynamic currency markets.

Be sure to keep abreast of the situation because exchange rates fluctuate every day and policies can change at any time.

→ To read about transferring money from your home bank account if you don’t have cash, read Money Transfers to Argentina