Cash is still king in current-day Argentina.

Thankfully, now credit and debit cards get a more favorable rate than they once did.

Until 2022, using credit or debit cards to pay for goods or services anywhere in Argentina was for suckers, because you’d be charged the country’s much lower official exchange rate.

Many visitors, not used to paying cash everywhere got tripped up by this when visiting Argentina.

Now using some credit and debit cards, visitors get a more favorable ‘MEP rate’ that is usually only 4-10% lower than the so called ‘Blue Dollar,’ or black market rate.

Just like Argentina’s official exchange rate, the ‘blue dollar’ rate, it fluctuates daily.

The MEP RATE 2025

Regulations were put in place in late 2022, that allow for what’s called the ‘MEP Rate’ for foreign credit cards.

Those using a Visa, MASTERCARD and AMEX card will receive a favorable rate. Those using Mastercard initially get charged the official rate, but receive a refund after a few days.

The MEP credit card rate is fixed by credit card companies and tends to be not as favorable as the ‘Blue Dollar’ Rate (but nothing is guaranteed in Argentina, so be sure to check.)

Credit card companies aren’t known to be transparent about international rates, so keep an eye on the rate you receive if you decide to use credit or debit cards in Argentina.

Between the lower MEP exchange rate and credit card fees, you may be enthusiastic to stick to money transfers.

*The MEP Rate does not apply to Apple Pay, QR code payments or MercadoPago (Argentina’s digital payment method) which looks like a normal credit card machines and will take your payment, but charge you the official rate.

Using Cash in Argentina

Although it may sound shady, exchanging USD or Euros on the black market is extremely common.

Money Transfer services are another good option.

Sometimes the rate received for a money transfer is even higher than what you get exchanging cash, but it can be a chore.

➡ Read our post about money transfer services such as Western Union for tips.

Check our currency converter to compare the Blue Rate to the Western Union Rate in real-time ➡

We still advise bringing some cash to Argentina because many small businesses don’t take credit cards, this is especially true the further you get from Buenos Aires.

Some businesses charge an extra fee of 10% for foreign cars because of the fees they incur.

Availability Abroad

Although the bills are beautifully designed, Argentine pesos are not widely accepted or valued outside of the country.

Most banks abroad won’t have any Argentine pesos to sell. If they do, they will often offer a very poor exchange rate, even below Argentina’s official bank rate.

Argentina’s Currency & Bills

Argentina’s currency is the peso.

Although the bills are beautifully designed, Argentine pesos are a pariah currency outside of the country.

Most banks abroad won’t have any Argentine pesos to sell. If they do they will give out a very poor rate even below Argentina’s official bank rate.

Currency Symbol

The Argentine peso is indicated by the symbol ‘$’, just like the U.S. dollar. However, to avoid confusion, it is often written as ‘AR$’ for Argentine pesos and ‘US$’ for U.S. dollars.The Argentine peso is indicated by the symbol ‘$‘ just like U.S. dollars.

Inflation and Price Quotations

Due to the high inflation rate, prices in Argentina change frequently.

As a result, prices are often quoted in U.S. dollars (US$) for clarity and stability.

Coin Circulation

The Argentine dollar was originally divided into one hundred cents, called ‘centavos’ but the centavo went out of circulation, as did the nickel, dime, quarter, and fifty cent coin.

In recent years, the 1-peso, 2-peso and 5-peso coins have largely disappeared from circulation, while a few 10-peso coins are still in use.

Banknotes

A new version of the five peso bill introduced in 2015 had Argentina’s most beloved founding father, José de San Martín on its face.

Due to currency devaluation caused by inflation, the bill only lasted until 2019 — four years before it was removed from circulation.

Today, the lowest denomination banknote currently in circulation is the 10-peso bill, which is worth about US$0.03.

Like the two-peso and five-peso bills, it may be retired soon due to inflation.

For a long time, the largest note was a $1000 bill, which was rolled out in 2018.

The AR$1,000 bill is worth less than US$3.

As you can imagine that means carrying little stacks of cash for a night out on the town.

In May 2023 a two thousand bill was introduced.

Inflation was so high, that the Argentine Central Bank just skipped over creating a $5,000 bill.

One year later in 2024, to relieve of everyone, a new $10,000 bill was introduced.

That’s Argentina inflation for you — all that counting of money was slowing down lines at the grocery store.

Pre-Travel Money Tip:

🚫 Do not exchange your foreign currency into Argentine pesos before arriving in Argentina. They probably won’t have it anyway but if available you will get the official rate

✅ Do bring USD cash and wait until you are in the city (if possible) to change money at the Blue Rate because you will need cash

You can also try to pay for something at McDonald’s or Starbucks in the airport arrivals area with USD and get the change in pesos, but make sure to check the rate they give first.

It’s also possible to book airport pickup in advance to avoid the exorbitant ATM fees outlined below and later change Blue dollars or use Western Union to get a more favorable rate.

As it is, if someone sends themselves US$100 via Western Union, it’s possible to be given the total in thousand or two thousand peso bills.

This means a relatively small amount of money could still entail carrying stacks of cash.

In an extreme — but possible scenario — if you exchange $100 USD for Argentine pesos at the rate of $1 USD = $1100 pesos, and you receive only 100 peso bills, you would receive 1,100 bills.

It might be worth bringing a roomy money belt to try accommodate all that cash.

Why is Argentina’s Money Situation So Weird?

In the 1990s the peso was pegged to the dollar at a fixed the exchange rate of 1:1 to the U.S. dollar through the Convertibility Plan.

This plan was in effect from 1991 to 2002.

After Argentina’s disastrous financial crisis of 2001, the peso was no longer pegged to the dollar and has since lost considerable purchasing power due to high inflation and government monetary policies.

In 2022, the parallel exchange rate had slumped to a record low, indicating a lack of confidence in the peso, prompting the Economic Minister to resign.

Argentina’s UnderGround Demand for Foreign Currency

Due to the inflationary nature of the Argentine peso, locals prefer to buy and save in foreign currency.

This is because Argentine pesos loses significant purchasing power sitting in the bank due to inflation.

But the government severely limits the amount of foreign currency that locals can purchase.

Most locals can’t purchase foreign currency legally at all.

Argentines with U.S. dollar accounts can legally purchase only US$200 a month.

These restrictions create a huge underground demand for foreign currency since locals also have no way to get their hands on any reasonable amount of foreign currency through official channels.

Tips for Dealing with Cash in Argentina

Navigating the complexities of Argentina’s currency can be challenging due to the country’s unique economic situation.

Travelers who want to get the best exchange rate with the least hassle should come to Argentina with coveted U.S. dollars, Euros or Reales to exchange for Argentine pesos at underground exchange houses.

Sometimes money transfer services provide a higher rate than black market cash exchange, but it also fluctuates day-to-day.

Here are some essential tips to help you manage cash effectively while traveling in Argentina.

Rounding Off Change

Due to the quickly devaluating currency, it’s a long-held Argentine custom to round up or down.

Historically, this was done with a few centavos, but now it involves anything under 40 pesos.

Requests for Exact Change

Almost every cashier will request exact change, especially when the amount is close to the bill you are handing over.

For example, if an item costs AR$920 and you hand over a AR$1,000 bill, the cashier might ask, “¿Tenes veinte?” (using the “voseo” form characteristic of Argentine Spanish), meaning “Do you have twenty?”

Small Change and Candy

If the change is a small amount, such as ten pesos, it is not uncommon for the grocer or cashier to offer a piece of hard candy in lieu of the change.

Alternately they may say “I owe you xx amount” or “Give the rest to me later.” (these little debts go both ways and are forgotten about afterwards).

This practice is more common in smaller shops or markets

Scarcity of Small Change and Large Bills

The scarcity of small change and large bills (like AR$10,000 notes) can still be an issue.

Travelers may end up carrying a lot of small bills and change after spending a day around town.

Conversely, cashiers and taxi drivers may also face scarcity of small change, making it advisable to hold onto your small change to avoid receiving candy instead.

Argentina’s historical small change problem has been alleviated thanks to the introduction of smart cards such as the electronic SUBE card for public transportation to ride Buenos Aires’ subway, buses, trains and premetro.

Taxi drivers are notorious for not having much change, another reason they seem to be losing out to ride sharing services such as Cabify and Uber.

(☛ Also be aware of the bank note switch scam if paying with 1,000 peso bills).

Which Bills to Bring for Blue Dollar Exchange

When coming to Argentina, it’s best to have crisp, new US$100 bills or Euros to exchange on the black market.

Smaller bills will fetch less on the exchange market.

Euros and Reales are also exchanged on the black market.

Beware that outside of Buenos Aires it can be more difficult to exchange Euros and Reales, so it may be a good idea to come with dollars or exchange them before traveling to more remote destinations.

Five, ten and twenty dollar bills will not be readily accepted by money changers or they may offer a bad rate.

It may be possible to use them in a store to get change in pesos or exchange them for a lower rate.

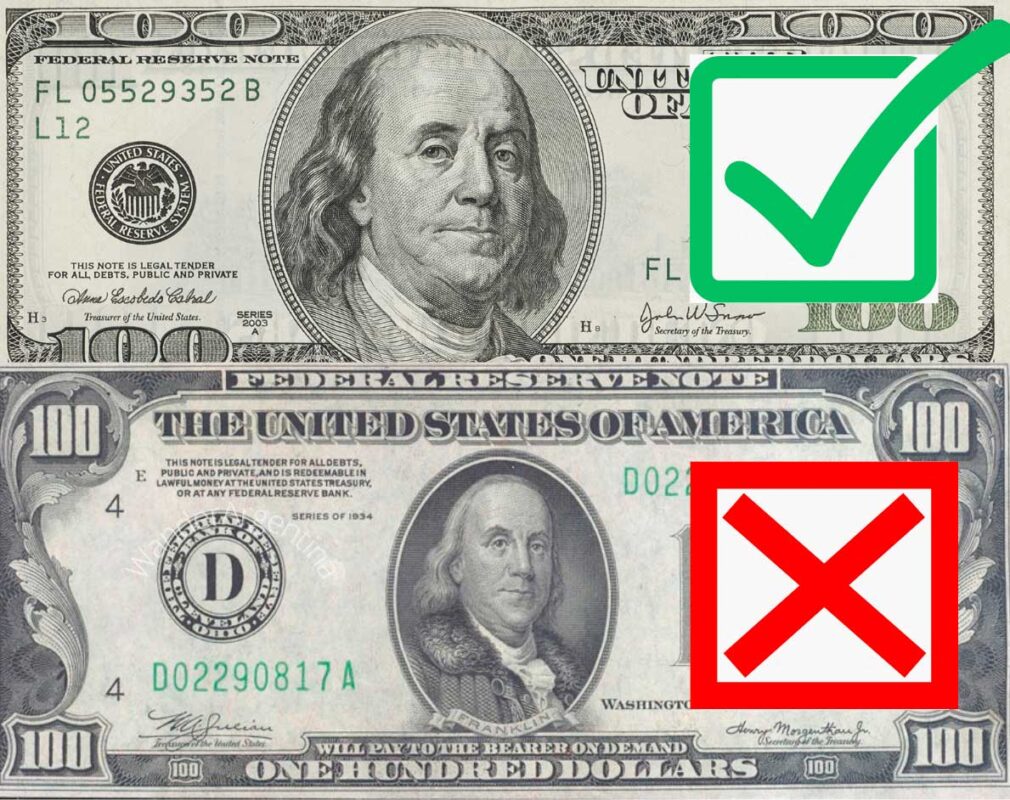

Bring ‘Big-Headed’ Bills to Argentina: The Benjamins

A peculiarity in Argentina (and much of South America) is that the preferred $100 dollar bills are those with a ‘big-headed’ Benjamin Franklin.

Older bills $100 bills (pre 1993) have a smaller head and will fetch 3-5% less exchanging on the black market.

No amount of explaining that the bill is worth equal value in the United States will change that.

This goes back to a rumor that the U.S. Federal Reserve was going to take the smaller-headed bills out of circulation or the possibility that they may in the future.

People in Argentina keep their money ‘under the mattress’ for a long time and want to be sure they have legal tender when they eventually need to convert it.

Condition of Bills

Aside from making sure to bring the right type of $100 bills, beware that foreign bills that are torn, worn or stained will also be rejected or fetch less on the underground currency exchange market.

Changing Money in Argentina

Bringing United States dollars to Argentina in order take advantage of the ‘blue dollar’ at least as a backup for transferring money is a good idea.

Although it’s in a legal grey area, it’s common and not as sketchy as it sounds.

See our post that details how to exchange money exchange on the black market on Buenos Aires’ Florida Street.

If carrying a lot of cash feels unsafe, bring at least a few bills and then sign up for one of the money transfer services.

As described on our Money Transfer page, you can to send money to yourself from your banking account, debit or credit card and receive a favorable rate without fussing with the underground exchange.

This is a way to get pesos at the blue dollar/black market rate.

It is legal and safe, but not as reliable as cash.

Keep in mind that the money transfer services are only open during the week during business hours and may be hard to find outside the major cities, that’s why cash is a good backup.

It’s not uncommon for foreigners to be caught out without cash on the weekends and holidays, simply because Western Union had no money or was closed due to protests, a World Cup win 😁 or for summer vacation.

This is when having some foreign cash on hand can come in handy.

Dealing with Money While Traveling around Argentina

Argentina’s smaller cities may have anemic ATM reserves, Western Union that are chronically low on cash and long lines to access cash.

It’s a good idea to stock up on pesos in Buenos Aires before exploring the country because it may be hard to access larger amounts in the countryside.

Also carry dollars in case you run short.

‘Cuevas,’ where one can change money, operate in most major cities and you may meet locals who want to buy dollars, which allows you to cut out the middle man.

Beware: due to Argentina’s economic peculiarities, relying on Western Union and ATMs to access cash while traveling around Argentina could lead to frustrating situations that waste your precious travel time.

Using Credit & Debit Cards 🛑

Many places now accept credit cards, which can offer a better exchange rate than the official rate but is usually not as good as the ‘blue dollar’ rate.

Credit cards are left for the end on this post because until 2022 when the more favorable MEP rate was created, foreigners tended to avoid using credit or debit cards at all, erm, costs.

It can be hard for people not accustomed to carrying cash to get used to this, but Argentina is definitely a cash economy, although locals have adopting credit and debit cards more widely.

That to the new regulations put in place in late 2022, credit and debit cards now allow for whats called the ‘MEP rate’ (‘Electronic Means of Payment‘ in its Spanish acronym).

Those who pay accommodation, tours and large restaurants with these credit cards in Argentina will get this rate.

If you get out of the tourist zone you will find many restaurants and stores do not accept credit cards, so carrying cash is still recommended.

Even before the parallel currency market returned, businesses frequently gave a better rate for paying ‘en efectivo‘ (cash) because of credit card transaction fees. This still holds true.

Often if you ask if there is a discount to pay in cash, the answer will be ‘Sí.’

For convenience and safety’s sake it’s best just to carry enough cash around to cover small daily expenses.

Those who don’t want to fuss with money transfer services or changing money on the black market can pay for larger items with their credit card if willing to lose the difference to the Blue Rate.

The added benefit to this is that visitors are entitled to a refund on the 21% Value Added Tax (VAT) if using hotels (over AirBnb) and making purchases at stores that are part of the Global Blue Argentina program.

Participation is noted by the Tax Free logo, which includes mostly multinational corporations, as stores such as those found in Galería Pacíficos (worth a visit.)

Keep the receipts to have them stamped by customs and get a refund at the airport on the way out.

Using ATMs in Argentina: Costs & Fees 🛑

It’s always good to have a bank card and credit card on your travels and, in Argentina, tucked away somewhere as a backup in case of emergency.

ATMs are abundant in most major cities and accept all types of debit and credit cards.

Even though travelers now get the MEP rate using their card, budget-conscience travelers to Argentina still avoid ATMs if adverse to losing money.

Argentina’s ATMs are know for:

‘Low Withdrawals limits — High Fees.’

So when accessing money from a foreign bank account in Argentina up to twenty or thirty percent of your money is eaten by fees.

ATM withdrawals are limited to a maximum of about U.S. $82-$200 per transaction for most banks, and only two withdrawals per day are permitted, so using ATMs proves impractical.

What’s worse is that the low withdrawal amounts are combined with an ATM fee of approximately US$10 or more per transaction.

This means that on top of getting the ‘MEP’ rate (if the credit card issuer respects it) visitors who use ATM’s also pay somewhere around 10% just to use bank machines here — and that’s withdrawing as much as possible at a time.

Even when the ‘Blue Dollar‘ market died down under the previous administration (who regularized the money situation), visitors sought out alternate options such as money transfer services and cryptocurrency to access their money from abroad to avoid Argentina’s high ATM fees.

Considering the difficulty and costs of using banks in Argentina it is understandable that visitors go to the black market to get their hands on some pesos.

While technically ‘illegal,’ the black market trade of currency is common in Argentina and there are no cases of foreigners getting in trouble with the law for trading money with a private entity.

Frequent travelers may want to find a home bank that reimburses fees on ATM transactions.

As a backup, savvy travelers would be smart to open a checking account with a bank back home that refunds ATM fees and doesn’t charge foreign currency fees, if available.

-In the U.S., Charles Schwab and some credit unions refund ATM fees, while others such as Capital One and USAA refund a limited amount.

-Australians should look into Citibank Plus, an ING Orange Everyday account and Schwab checking.

-Canada doesn’t have many good options for banks that refund ATM fees, but try out ScotiaBank/Tangerine-ING, HSBC Premier or TD Bank. Tangerine is an online bank that can be useful for Canadians who want to collect their pension while in Argentina.

-In the UK most banks do not refund the banking fees, but Nationwide has some of the best rates. The mobile-based Starling Bank is also worth investigating.

(None of the above suggestions are sponsored, this is just based on word on the street)

Many of the checking accounts that refund international ATM fees have certain requirements, so you’ll have to figure out what works for your individual situation.

Regardless of your home bank, if you absolutely have to use your bank card in Argentina, to get charged as little as possible withdrawing money try to use ATMs that are on your home network.

The Argentine national bank mentioned above, Banco de la Nación (which is on the LINK system, shown by a green sign saying ‘Link’) has lower withdrawal fees at its ATMs than the private banks.

To be on the safe side, (➡️ in case you don’t read this article about common scams and fall victim to the ‘bird poop trick’) carry two different bank cards, kept in different places, during your stay.

Extra Banking Tip: Beware of Card Eating ATM Machines

When using ATMs beware that sometimes they are slow to spit the card back out at the end of the transaction.

Many a traveler has withdrawn money and walked away, accidentally leaving their card in the machine.

What to Do if Your ATM Card is Eaten in Argentina

If that happens, you can try to go back to the bank the next day to retrieve it when they refill the ATMs between 2-3 p.m.

If it’s the weekend, you can try to go back the next working day, but it may take a miracle to get it back at that point.

Using Checks in Argentina 🛑

Those wondering if checks might be a good alternative option to having to carry cash will be disappointed.

Traveler’s checks are, at best, a total headache and at worse virtually useless in most of Argentina. One reliable place to cash them is at one of the three American Express offices in Buenos Aires, but there are more convenient options than using traveler checks these days.

Personal checks are virtually unheard of in Argentina, it’s even illegal to send them through the mail.

Leave your personal checkbook at home, it will do you no good in Argentina.

➡️ Read our post about the Current Exchange Rates and compare the live Official, Blue Dollar, Western Union rates on our currency converter

➡️ Read our post on using Money Transfer Services such as Western Union or Remitly to get the ‘Blue Rate’. Get a credit of $20 on your first transaction!